The task committee members will be responsible for collecting, assessing and evaluating the risks and opportunities caused by the climate-related issues; performing risk identifications; acting on countermeasures and strategies against material climate-related threats; following up with the preventive and corrective actions, and quantifying the greenhouse gas emission inventory.

Report to the Board of Directors annually on the implementing progress and goals achieved.

The strategy for addressing climate change risks and opportunities can be divided into various areas, including greenhouse gas reduction management, energy supply, climate anomalies, potential environmental risks, and operational activities. A total of 31 risks and 2 potential opportunities are identified, categorized into transformation risks and physical risks.

Risk and operational impact analysis is conducted based on the likelihood of occurrence, scope of impact, and short, medium, and long-term risk identification, with a financial impact threshold of NT$16 million or above as a substantial financial impact indicator. Scenario simulations are conducted using the country's Intended Nationally Determined Contribution (INDC) and

Representative Concentration Pathway (RCP). Based on the above two scenario simulations, no significant medium to long-term risks were identified from the extreme climate events simulated, including high temperatures, sea-level rise, and flooding.

For the short-term risks, we identified and prioritized three categories of material risk and opportunity to Fwusow Industry, including market risks and transformation risks/opportunities.

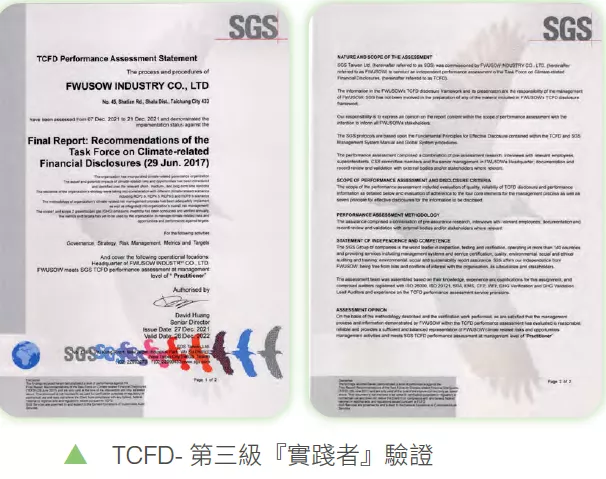

Please refer to our company website for relevant climate-related strategy, financial impact, management target and the TCFD report.

3 Key Issues

- Risk of Price increase of imported raw material

Main raw material, corn & soybean, all imported. Production yields could be influenced by climate factors; if yields are low then price would go up then lead to higher cost of goods sold for the company; thus, lower profit.

Strategy

- Factor in the foreign planting conditions, domestic delivery time, gasoline price changes, and climate conditions to make suitable purchase adjustments.

- With the price upticking trend, increase our inventory by taking advantage of our silo storage.

Action Taken in 2022

- Purchase of local grown corn: 12,253,870 kg

- Purchase of local grown quinoa: 4,000 kg, local grown peanut 60,200 kg

Metrics and Targets

- Source from different countries and to increase the purchase of local grown corn to more than 15,000 tons.

- Timely and flexible procurement strategy to reduce price volatility risk.

- Increase inventory (2 months)

- Product sale price adjustments.

- Risk and opportunity in the regulations of Renewal Energy

generation. The financial expense to fulfill the city requirement is about NT$6 million annually.

Strategy

Our company works with solar panel vendor. We provide our plants for the vendor to install solar panels to generate renewable energy to sell to Taipower.

Thus, we also take in partial income from the sale proceeds.

Action Taken in 2022

- Increased solar energy generation by 833kWh in 2022.

- Total solar energy generated in 2022: 3,256.843 kWh, increased 3.6% as compared to 2021.

Metrics and Targets

To increase solar energy generation by 499 kWh in 2023.

- Voluntary Quantify GHG emissions – positive sustainable corporate image

None of the Fwusow Industry plants are regulated to perform the GHG emissions inventory quantification.

However, as a reputable company, we take the initiatives in quantifying the emissions at our plants.

Strategy

- Comply with the process of carbon footprint labels in an ongoing efforts in energy conservation and carbon reduction.

- In the next 3 years, we will expand our scope of GHG emissions inventory to include Lukang Plant; within the next 5 years, Kaohsiung plant will be quantified as well.

Action Taken in 2022

- GHG Emissions Disclosures are reported in the Sustainability Report Chapter 3.5.

- Emission intensity dropped from 1.6 kgCO2/thousand $ in 2021 to 1.43 g CO2/thousand $ in 2022.

- Lukang plant has completed the GHG Emissions Quantification.

Metrics and Targets

- Verification of GHG emissions inventory completed by an independent third-party vendor annually.

- 2023 annual reduction goal: reduce electricity consumption by at least 1% or more; GHG emissions to reduce by 148 tCO2e or more.

- Adopt ISO 50001 Energy Management and ISO 14064-1 GHG Emissions Inventory.